August 2021

Inflation Overview

What is it?

The economic definition of inflation is a general rise in prices in an economy over a given period of time. So, what does this actually mean? When prices of everyday items and goods rise, each unit of currency buys fewer goods and services. Inflation is most commonly measured by the consumer price index (CPI), which is essentially measuring the change in prices of a basket of consumer goods and services, such as phones and cars.

There are two main drivers of inflation; cost (push) and demand (pull). Cost push inflation occurs when supply costs push prices higher. Demand pull inflation occurs when increased demand from consumers pulls prices higher. Demand pull inflation is generally considered more economically friendly andsustainable as it is reliant on strong consumer demand and thus a strong economy. Cost push inflation can induce upwards price pressures on consumers but without adding much to economic growth and is therefore less desirable.

Good or Bad?

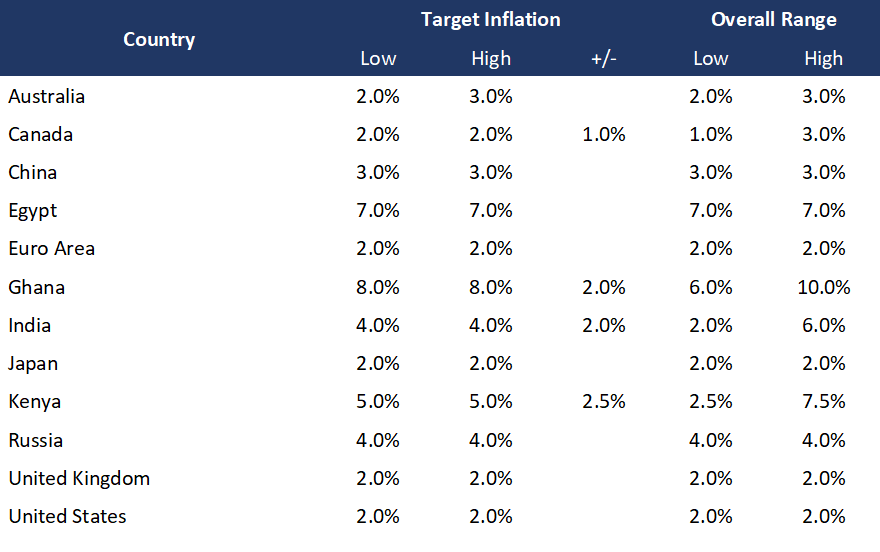

Most economists agree that some inflation is acceptable when it is low and stable, as it generally comes with increases in economic output and productivity. However, there is little agreement on what constitutes an acceptable rate of inflation within an economy. The table below shows the inflation targets of various central banks around the world

The dispersion is quite startling, with some targeting inflation as low as two percent or lower, and others targeting an upper limit of as much as eight percent (10 percent when factoring in the additional allowance). Generally, emerging economies are prepared to accept higher levels of inflation as their economies grow fast, whereas developed countries aim for a lower but steadierrate of inflation. It must also be remembered that many central banks have goals other than inflation control, such as economic growth, optimal levels of employment, exchange rate stability and also financial stability.

Is Inflation Coming?

Inflation forecasting is historically hard and imperfect, with almost zero consensus amongst analysts as to the likely direction of inflation. Even amongst those who agree there will be inflation, there is no agreement on the scope or timeframe. This gets even more complicated when you begin breaking it down by region or even country, with the effects of globalisation being that price increases are often felt across economies simultaneously. Predicting inflation is also a case of trying to foresee what central banks will do with monetary policy, something that is itself notoriously hard to do. Central banks have tried to make this easier by introducing something called ‘forward guidance’ where they explain what their intentions are, but they have not followed this very closely in practice.

Key Hedges

When we talk about inflation hedges (protection) we are talking about assets that’s value will be less negatively impacted in an environment where we see increasing rates of inflation. Diversification is key as there is no guarantee of which assets will perform in any given market environment. The most commonly used assets, though not necessarily all good options, are below:

- Equities

- Infrastructure

- Real Assets

- Commodities

- Gold

- TIPS

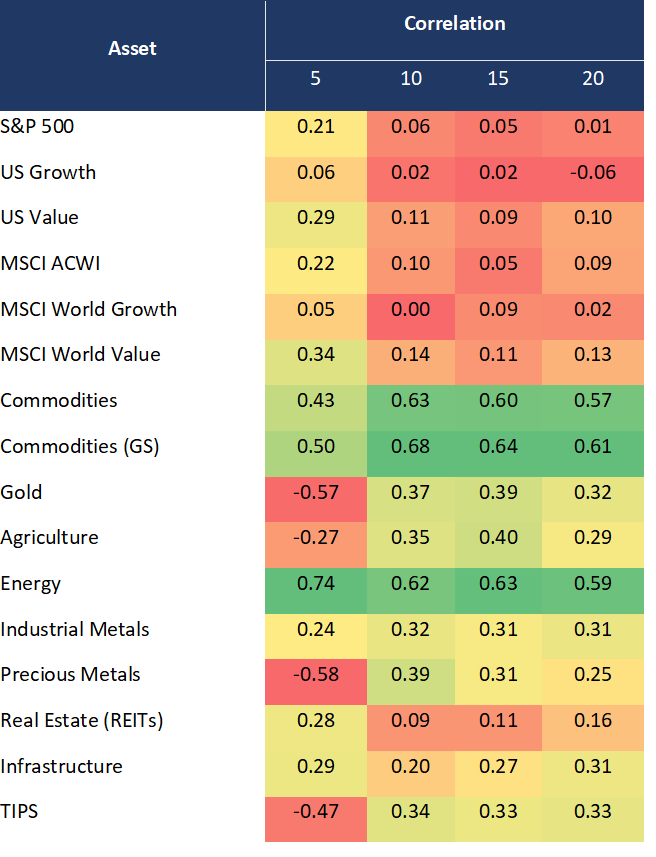

The below table shows the correlation of each of these assets, including abreakdown by equity style, over varying time periods up to a maximum of 20years against movements in US CPI. These are calculated using year-on-yearchanges on a monthly frequency.

Looking at US Value and MSCI World Value, it is evident that they are muchmore highly correlated to changes in inflation than growth equities, thoughnone are particularly well correlated.

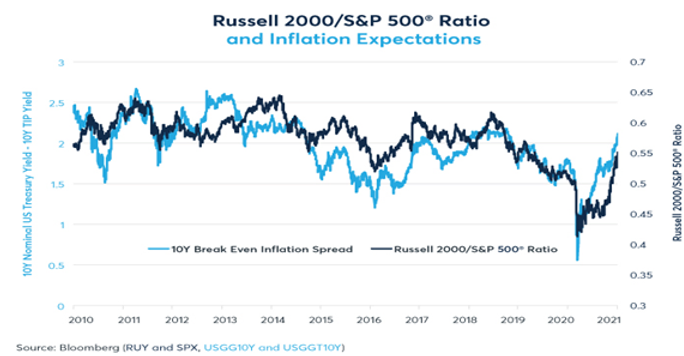

There is a clear positive correlation between the large/small-cap spread andinflation expectations, and so where inflation is expected, diversifying intosome small-caps may be wise.

Listed infrastructure and listed real estate are said to provide protection given their ability to raise yields (maintain real yields) as inflation increases, thus protecting real value of earnings. This is a similar argument to why equities areoften looked upon as an inflation hedge. The difference with infrastructure especially, is that infrastructure contracts are often themselves linked to inflation.

Bonds are generally poor inflation hedges, however a subset of the fixed income universe called Treasury Inflation Protection Securities (TIPS) can offer good protection as their coupons are lined to the inflation rate. TIPS tendto perform well during times when inflation expectations are high, however their performance during inflationary cycles is mixed. They do though offer the best option in the fixed income space.

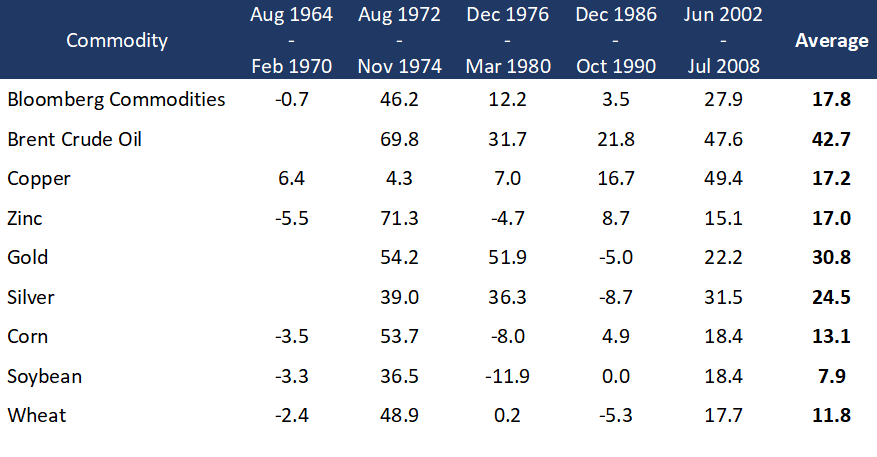

Commodities can often be a significant factor in causing inflation, which may go some way to explaining why they have sometimes been great inflation hedges. The table below shows the real performance (after inflation is accounted for) of a variety of commodities during past inflationary cycles:

As we can see, commodities have broadly tended to perform really well during inflationary cycles and are well correlated to inflation changes as demonstrate by the correlation table. Partly this is because commodities make up a large part of the consumer price index, with energy and food being the most important factors here. Energy in particular is highly correlated to inflation (positive 0.74 over the past five years) and has performed exceptionally well over different inflation cycles.

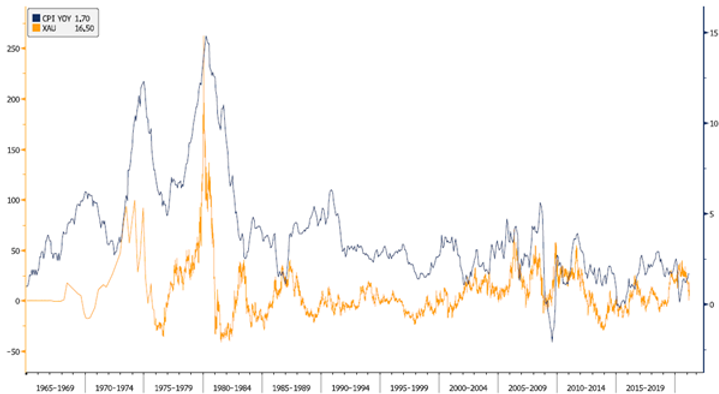

Gold has also performed, though is less well correlated than energy. The average real return for gold during periods of inflation is 30.8%, with particularly strong performance during periods of high and fast inflation, as seen in the following chart:

Where inflation has spiked, gold has tended to offer good returns, though as discussed previously, the relationship has broken down somewhat more recently. Gold is seen as a potential inflation hedge because its value cannot be eroded away by the excess printing of money (quantitative easing), which we’veseen in abundance since the financial crisis and in record amounts during and post-Covid.

Conclusions

The world has made remarkable strides in establishing a framework to control the Covid pandemic. The vaccine rollout has been a saving grace for many countries, although a large number of emerging economies are still struggling. The expect recovery in global economic activity is beginning to feed through to companies and consumers, and the markets have continued to be positive, in most cases.

We believe that this rapid recovery is likely to come with a price, and that is a spike in inflation. Although the Federal Reserve, the ECB, Bank of England, and many other central banks, have given guidance that a major spike in inflation is likely to be transitory, we are taking a more cautious approach.

Hence, we believe that there is a short-term risk of this higher inflation leading to a rise in interest rates, should the rise prove to be persistent and above trend. Typically, such a rise would most negatively affect those “growth” stocks which are highly leveraged. Conversely, traditional “value” stocks which are less leveraged and cash generative will benefit from such a policy change. Indeed, we have already seen the recovery in the fortunes of the world’s major banks, as they reduce the provisioning for bad debt, a harbinger of more liquidity being provided to corporates.

At A&J we are positioning our portfolios in such a way as to hedge against this future risk of inflation. At the top level, we are positioned overweight equities and underweight fixed income, with a broadly positive view on the global economy and thus on risk assets. Fixed Income markets look particularly unattractive given record low yields and central banks that are about as accommodative as possible. We are increasing exposure to value equities which historically offer a better hedge during inflationary cycles than their growth counterparts, but will be maintaining growth exposure which continuesto benefit from the uncertainty in global GDP and are well positioned to benefit from potentially permanent shifts in consumer behaviour driven by the pandemic. The old value versus growth balance has been challenged over the pandemic, as high growth sectors such as technology continue to disrupt the historic patterns of business. We will also be increasing our exposure to small-cap equities which as we’ve shown in this report are more correlated to inflation expectations than large-caps.

In fixed income, where we are underweight, we will be adding exposure to TIPS and reduce duration (sensitivity to interest rates) as much as possible. Fixed income plays an important role in diversified portfolios, however offers little attraction currently.

We will be introducing to client portfolios a suite of commodities to serve as inflation and crisis protection. Gold performs particularly well during crises and an environment of heightened inflation expectations as it maintains its purchasing power over a long period. At the same time, our energy allocation is tactical and dependent on a successful re-opening of economies, and offers the best inflation hedge in the commodities space.

Disclaimer:

The content of this publication is for information purposes and should not be treated as a forecast, research or advice to buy or sell any particular investmentor to adopt any investment strategy. It does not provide personal advice based on an assessment of your own circumstances. Any views expressed are based on information received from a variety of sources which we believe to be reliable but are not guaranteed as to accuracy or completeness. Any expressions of opinion are subject to change without notice.

Past performance is not a reliable indicator of future results. Investing involvesrisk and the value of investments, and the income from them, may fall as wellas rise and are not guaranteed. Investors may not get back the original amountinvested.

Produced August 2021