The Importance of Diversification

Diversification

The rule to long term investment success is diversification. You should always have an amount of cash available to you in case you need it in a hurry, but no single asset class should be relied upon once your portfolio starts to build beyond those emergency requirements. Equities, bonds and property don’t offer the same guarantees, but if you understand them and are happy to accept at least some volatility, the longer term value of your portfolio might be better for spreading at least some of that money around.

NB: If an institution with which you hold deposit savings is declared insolvent, the capital will be guaranteed by the Financial Services Compensation Scheme up to a maximum of £85,000 per person, per institution. If you hold more than £85,000 on deposit, therefore, it may be sensible to spread it across more than one institution.

Financial News

Monthly Update: April 2024

3rd April 2024 Global Outlook In the UK, inflation surprised by coming in lower than expected, putting pressure on the Bank of England to cut

Letter from CEO – Gareth Jones

25th March 2024 Letter from CEO – Gareth Jones Dear Sir/Madam, Since 1985, I have been committed to providing an excellent service to all our

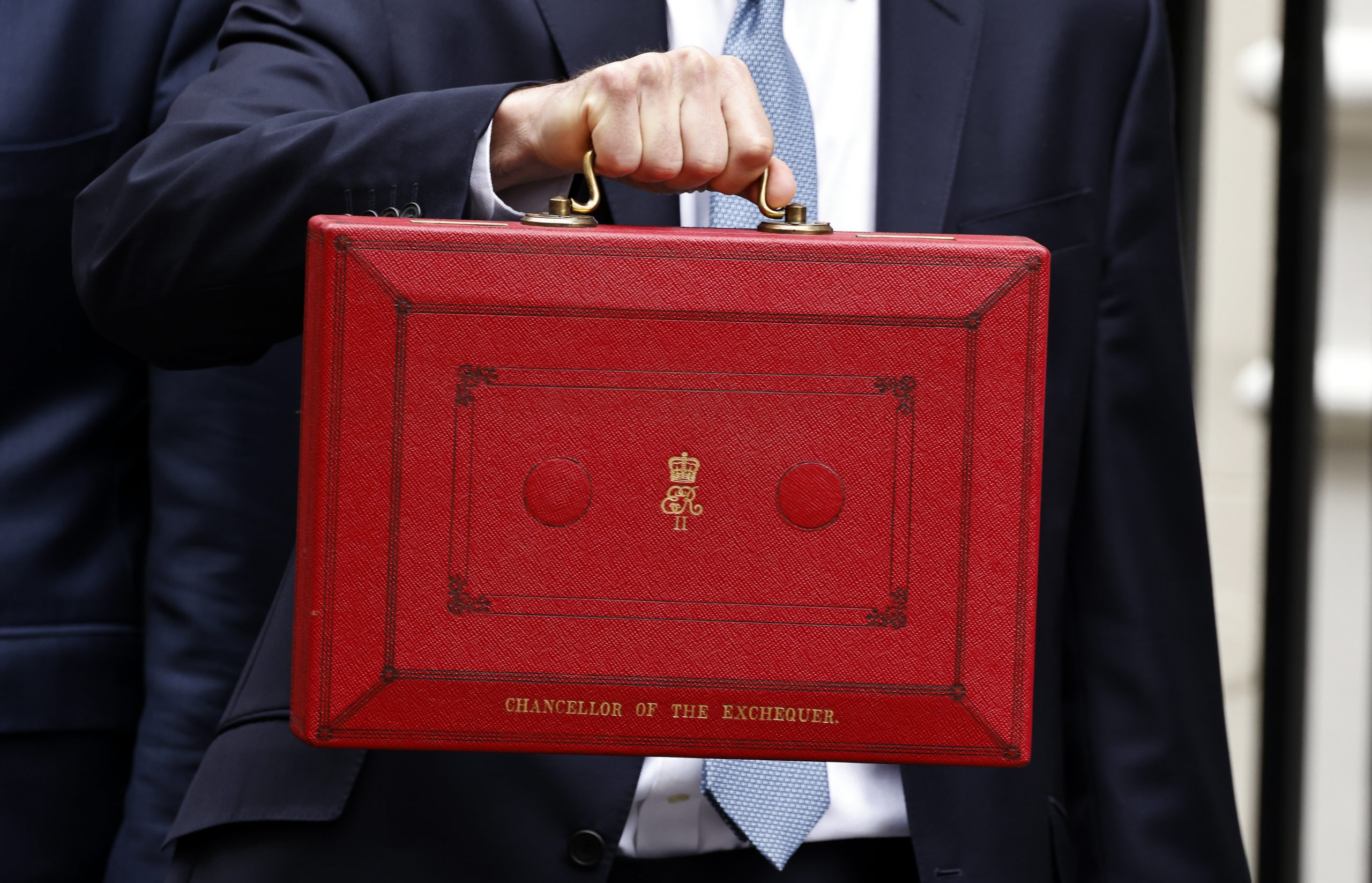

Spring 2024 Budget Guide

8th March 2024 Spring 2024 Budget Guide On Wednesday, 6 March, Jeremy Hunt, the Chancellor of the Exchequer, addressed the Commons to deliver the Spring

Monthly Update: March 2024

5th March 2024 Global Outlook The Magnificent Seven continued to rally with NVIDIA leading the charge. Microsoft, Google parent Alphabet, Amazon, Apple, Meta, NVIDIA, and

Get In Touch

Leave us a message

A&J Wealth Management Ltd

Sawfords

Bigfrith Lane

Cookham Dean

Berkshire

SL6 9PH

01628 480200

enquiry@ajwealth-management.com

Phone:

01628 480 200

Email:

enquiry@ajwealth-management.com

Address:

Sawfords,

Bigfrith Lane,

Cookham Dean,

Berkshire,

SL6 9PH

© 2024 A&J WEALTH MANAGEMENT LTD A&J Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register, no 428590, at www.fca.org.uk/register Registered in England, Company no: 5105933. Registered Head Office: Sawfords, Bigfrith Lane, Cookham Dean, Maidenhead, Berkshire SL6 9PH